The Carbon Assets Tracking System (CATS) is an Emission Reduction (ER) transaction registry, designed and implemented to support the issuance and transactions of ER units generated under the World Bank Programs.

By Bong Thi Le, Senior Finance Specialist and Julian Gonzalo, Senior Climate Change Specialist at the World Bank Group

Carbon markets can be a powerful tool for mobilizing climate finance — but only if the underlying systems are credible, transparent, and trusted. At the center of those systems sit carbon registries: the infrastructure that records, transacts, tracks, and safeguards carbon credits.

To support clients in accessing carbon finance, the World Bank developed the Carbon Assets Tracking System (CATS). CATS enables countries to issue, transfer, retire and track emission reductions (ERs), while laying the groundwork for the development of country-owned registries over time.

Why carbon registries matter — and what is the role of CATS?

Carbon registries play a foundational role in carbon markets by managing the registration of carbon programs and recording verified emission reductions generated under those programs. By tracking each ER from issuance through transfer and final retirement, registries help prevent double counting and ensure that each credit is accounted for only once, providing a transparent and reliable accounting system that underpins trust in carbon markets.

While many countries are still developing their own carbon registries, CATS can issue and transfer emission reductions on their behalf, supporting payments for verified emission reductions delivered under World Bank-managed carbon funds. In doing so, CATS reflects a broader evolution in the role of these funds — from a model centered on purchasing emission reductions to one that increasingly enables countries to connect with carbon market infrastructure and engage with markets over time.

Through this process, countries gain hands-on experience with registry operations, controls, and market interfaces, helping build the institutional knowledge needed to design and operate domestic carbon market infrastructure over time.

CATS currently serves client countries and donors participating in programs under the Forest Carbon Partnership Facility (FCPF), the BioCarbon Fund Initiative for Sustainable Forest Landscapes (ISFL), the Carbon Initiative for Development (Ci-Dev), and the Transformative Carbon Asset Facility (TCAF).

Supporting countries in practice

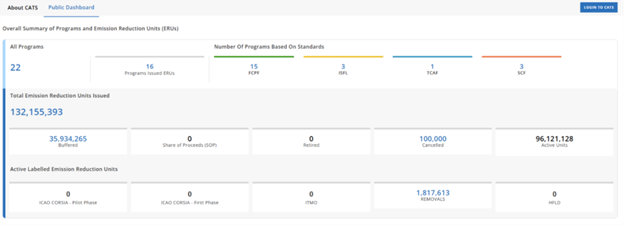

To date, 21 country programs and 16 donor countries have been onboarded to CATS, with more than 132 million tons of carbon credits issued, supporting over $394 million for result based payments across 16 country programs.

CATS Public Dashboard provides comprehensive and transparent information regarding the WB ER programs and the credits issued and transferred, as well relevant data encoded within unique serial numbers, in accordance with international standards

In Costa Rica, 8.7 million ERs have been issued through CATS, supporting $16.4 million in payments and enabling the country to mobilize additional finance through voluntary market transactions. Viet Nam has issued over 22.3 million ERs in CATS and became the first country to sell option ERs beyond its contracted delivery volume. Uzbekistan issued one million ERs through its pioneering TCAF-supported Innovative Carbon Resource Application for Energy Transition (iCRAFT) program, with a portion of revenues pledged to support vulnerable households affected by energy tariff reforms.

CATS also supports countries that have adopted the Standardized Carbon Framework (SCF) — a country-owned crediting framework — by serving as an interim registry while domestic systems are under development. For example, Rwanda and Madagascar have used CATS to issue their first SCF ERs while building their own registries, gaining practical experience in operating carbon market infrastructure, including registry governance, transaction controls, and data transparency — experience that directly informs the development of domestic systems.

Enabling market access with integrity

CATS is aligned with international compliance frameworks, including Article 6 of the Paris Agreement and ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). The system applies rigorous due diligence and internal controls, including financial integrity checks, and assigns a unique identifier to each ER unit issued and transacted.

This ability to clearly identify ownership and ensure that the same ER cannot be claimed or transacted more than once is a defining feature of any credible registry and a prerequisite for market trust. ERs issued through CATS also meet stringent environmental and social requirements under World Bank supported programs, contributing to the issuance of high-integrity credits.

CATS further supports funding mobilization by enabling eligible ERs to be re-issued in independent registries such as Verra and ART for commercial transactions. In Côte d’Ivoire, for example, the re-issuance of excess ERs enabled a private-sector transaction that generated $23 million in additional revenue for the country.

To enhance transparency across markets, CATS is also connected to the Climate Action Data Trust (CAD Trust) — a public metadata platform that links major registries and helps reduce risks of double counting and double claiming across systems.

Lessons from CATS for Building Market Infrastructure

Experience with CATS highlights several practical considerations for countries developing carbon market infrastructure. First, clear registry design is foundational: well-defined rules on issuance, ownership, transfers, and retirement — supported by unique identifiers — are essential to preventing double counting and establishing trust from the outset. Second, market access depends on interoperability.

Finally, capacity is built through use. Operating within CATS has provided countries hands-on experience in registry governance, data management, and transaction controls, informing the design and operation of domestic systems over time. Throughout this process, integrity frameworks — including environmental and social safeguards, financial controls, and benefit-sharing arrangements — are not optional add-ons but core elements of credible market infrastructure. They are integral to managing operational and reputational risks and sustaining confidence in carbon markets.

Taken together, these lessons underscore how registries can function not only as accounting tools, but as core market infrastructure — supporting countries as they build institutional capacity and engage with carbon markets on their own terms. In this context, CATS serves as an enabler by providing a pathway for client countries to monetize emission reduction activities and attract additional sources of finance to support their climate and carbon market agendas. Revenues generated through carbon credits can, in turn, help countries stimulate innovation and support job creation in emerging sectors.

To explore more, visit the CATS website.